It's no secret that mobile banking has exploded in popularity as a convenient alternative to visiting a branch when you need banking services. Lloyds Bank, which has been in operation for over two centuries, has followed suit.

The bank released the Lloyds Bank Mobile Banking app in 2016. The app provides access to nearly all of the bank's services for individual customers. Customers can access many services, including money transfers, check deposits, PIN viewing, and more.

Check the Lloyds Bank Mobile Banking app's features and content below. Discover how to download the Lloyds Bank Mobile Banking app and create an account.

- What Is Lloyds Bank?

- What Is the Lloyds Bank Mobile Banking App?

- How Can You Utilize the Alerts Feature of the Lloyds Bank App?

- Can You Deposit Checks through the Lloyds Bank App?

- Can You Freeze Your Cards Using Lloyds Bank?

- How Can You Apply for a Credit Card via the Lloyds Bank App?

What Is Lloyds Bank?

Lloyds Bank has been in operation since June 1765. It is one of England and Wales's major retail and corporate banks, with numerous branches and ATMs around the UK.

John Taylor and Sampson Lloyd established the first bank in Birmingham. The bank joined the Trustee Savings Bank in 1995. Then, Lloyds Bank relocated its headquarters to London, yet still maintains offices in Wales and Scotland.

By 2012, Lloyds Bank had over 16 million customers and small companies. Lloyds Bank has a partnership with the Bank of Scotland and Halifax to provide banking services to consumers in Scotland and Northern Ireland.

Customers and clients of Lloyds Bank can bank by phone and online 24 hours a day, seven days a week. To suit customer needs and make banking more convenient, the bank began offering mobile banking services in 2016.

What Are the Services Offered by Lloyds Bank?

Lloyds Bank wishes to provide its customers with financial and banking services and assistance. It is well-known for providing excellent financial aid because Lloyds Bank is dedicated to assisting struggling people.

Lloyds Bank provides credit cards, loans, auto finance, savings, investments, pensions, house, insurance (car, van, and life), and mortgages to its customers.

All of these financial services are now available through its website, as well as its online and mobile banking apps. These platforms are available to all Lloyds Bank customers.

What Is the Lloyds Bank Mobile Banking App?

Since many people want easy-to-use banking services, Lloyds Bank created its mobile banking app to meet customer needs. In 2016, Lloyds Bank launched its mobile banking application for Android and iOS devices.

Thus, Lloyds Bank customers can get the mobile banking app on both the Google Play Store and the Apple App Store. The banking app is free, but customers have to open an account with Lloyds Bank to be able to use the app. After signing up, customers can easily use Lloyds Bank's services.

For mobile banking with Lloyds Bank to work well, users' devices must have the latest version of iOS or Android. Opening the app and using its features require a stable Wi-Fi, 3G, or 4G data connection.

Users also need an Apple App Store or Google Play account for easier verification. Be sure that the phone number the bank has on file for you is up-to-date because you'll need it to sign up for the mobile banking app.

What Is the Account Registration Process on the Lloyds Bank App?

To sign up for an app account, Lloyds Bank requires five steps. First, customers must give their names, dates of birth, postcodes, and Lloyds Bank account numbers. Each user must then create their own User ID and password.

The software also requests that new users read the Terms & Conditions. Lloyds Bank Mobile Banking will also call the registered phone number to confirm the account's security. This security check will ensure that they are genuine Lloyds Bank customers.

Then, a verification code will appear as a four-digit code on the device screen. Users can enter the code manually or wait for Lloyds Bank Mobile Banking to confirm successful registration.

How Can You Utilize the Alerts Feature of the Lloyds Bank App?

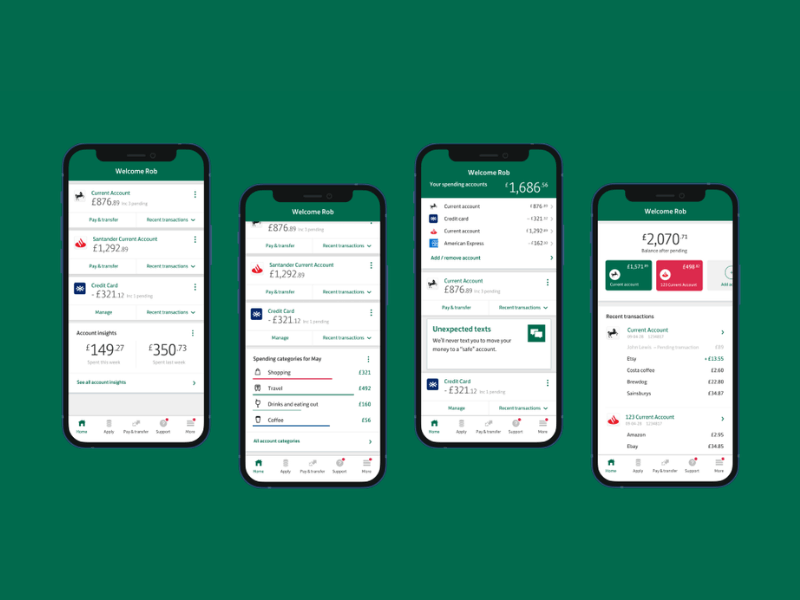

Lloyds Bank Mobile Banking is convenient, assisting customers in keeping track of their activities, transactions, and other vital financial reminders. Users will receive many notifications on the app to keep them informed of their account's activity.

"Smart Alerts" notify users when a transaction is successful, so they don't have to wonder if it was completed correctly. Smart Alerts notify clients when money enters or exits their accounts.

Lloyd Bank Mobile Banking also sends "Purchase Alerts" when you use your debit card to make a purchase. As soon as the purchase is completed, the message will be sent. The alerts will confirm the success of the transaction and trace its history.

Instead of manually tracking transactions made with a Lloyd Bank debit card with "Purchase Alerts," the app's "Spending Breakdown" function provides a weekly summary of the purchases made.

How Can You Set Notifications on the Lloyds Bank Mobile Banking App?

Lloyds Bank Mobile Banking users must choose for themselves which alerts they want to see.

To set up this feature, tap the "Profile & Settings" icon in the upper right corner of the app's home page to turn on the mobile alert. Then click the "Settings" button and look for "Messages." From here, users can easily toggle the various notification options on or off to get the alerts they want.

Can You Deposit Checks Through the Lloyds Bank App?

The Lloyds Bank Mobile Banking app lets you deposit checks, one of its most useful and innovative features. Lloyds Bank customers don't have to go to branches to deposit and process checks.

This service is proven easy to use, quick, convenient, and safe. Users of the mobile banking app can take a picture of the check to be deposited. Lloyds Bank Mobile Banking will read the information and automatically process accepted checks through the app.

Through the app, Lloyds Bank ensures that the money will be available the next business day.

How Can You Transfer Money via the Lloyds Bank App?

Lloyds Bank Mobile Banking users can send and receive money from anyone, similar to the functionality offered by other mobile banking apps. The only thing they have to do is give them a mobile phone number that is registered in the UK.

Users must add these phone numbers as contacts to send money right away. They will not have to say anything about their bank accounts.

Users must first choose the contact they want to send money to and then type in the amount they want to send.

Can You Freeze Your Cards Using the Lloyds Bank?

Lloyds Bank wants its consumers to have more say over how their debit and credit cards are used. As a result, they allowed them to utilize the Lloyds Bank Mobile Banking app at any moment to freeze and unfreeze their account transactions.

This feature is incredibly convenient since you do not need to phone the bank or visit a branch to report lost cards. Aside from missing cards, this feature can restrict how and where the cards can be used.

To freeze or unfreeze a card, tap the "Manage card" button at the bottom right of the app's home screen. Look for and select the option "Card freezes and limitations."

Users can go through the list of cards to select the ones they want and toggle the various freeze parameters, such as whether the cards can be used for transactions, on or off. These modifications will take effect immediately.

Can You View Your PIN Using the Lloyds Bank App?

When customers have more than one card, they may sometimes struggle to remember their various PINs. Lloyds Bank knows how to handle this problem by allowing customers to see or access their PIN through the app.

When a customer uses Lloyds Bank Mobile Banking to set up an account, their PIN is saved in the app so they can use it later. The only rule is that the people who use the cards must be the main cardholders on those cards.

How Can You Apply for a Credit Card via the Lloyds Bank App?

Anyone interested in applying for a credit card with Lloyds Bank can submit their application using the bank's official website or the mobile banking app to complete the process.

Choosing to use the Lloyds Bank Mobile Banking app will lead you to the bank's official website. You will be required to fill in basic information, such as your bank account details, annual income, and spending commitments, among others.

It would be best to determine your qualifications before applying.

Check the bank's website to see if you meet the requirements for eligibility. This will tell you what kinds of credit cards you are eligible to apply for and how much credit the bank can offer you.

Does Lloyds Bank Adhere to the Open Banking Principles?

Lloyds Bank ensures that its customers have more control over their data or personal information per recent modifications to the United Kingdom's data privacy and access policy. This will allow them to bank online or any other way they like.

Lloyds Bank's mobile banking app gives customers new options to manage their money. Users can now share their information between mobile banks. Users can view all their bank accounts in one area, including those from various banks.

Banks and non-banking companies can also offer these new services under the Open Banking policy. This increases the level of competition. Lloyds Bank assures its customers that it is doing all possible to make these new services available and useful.

Conclusion

Lloyds Bank ensures that its customers can access its financial services anytime and from any location by providing them with the Lloyds Bank Mobile Banking app.

Customers can access Open Banking services, receive notifications, deposit checks from anywhere, transfer money only, receive free cards, and view their PINs on the app.