The Nationwide Mobile Banking app is for people who want to check on or manage their finances while on the go. It aims to help its customers stay on top of their finances and ensure that their money is always safe and secure.

Check out the Nationwide Mobile Banking app's features and content in this article. Discover how you can have a safe mobile banking experience on the app. Learn how to apply for a credit card through the Nationwide Mobile Banking app.

- What Is the Nationwide Mobile Banking App?

- How Can You Setup the Nationwide Mobile Banking App?

- What Are the Security Features of the Nationwide Mobile Banking App?

- How Can You Transfer Money Using the Nationwide App?

- How Can the Nationwide Mobile Banking App Help You Save Money?

- How Can You Apply for a Credit Card via the Nationwide App?

What Is the Nationwide Mobile Banking App?

Mobile banking has become increasingly popular for people to manage their finances. The Nationwide Mobile Banking app makes it easy for individuals to access their accounts from anywhere at any time.

The Nationwide Mobile Banking app is accessible to customers or members of the Nationwide Building Society. The app allows these individuals to manage their finances on the go.

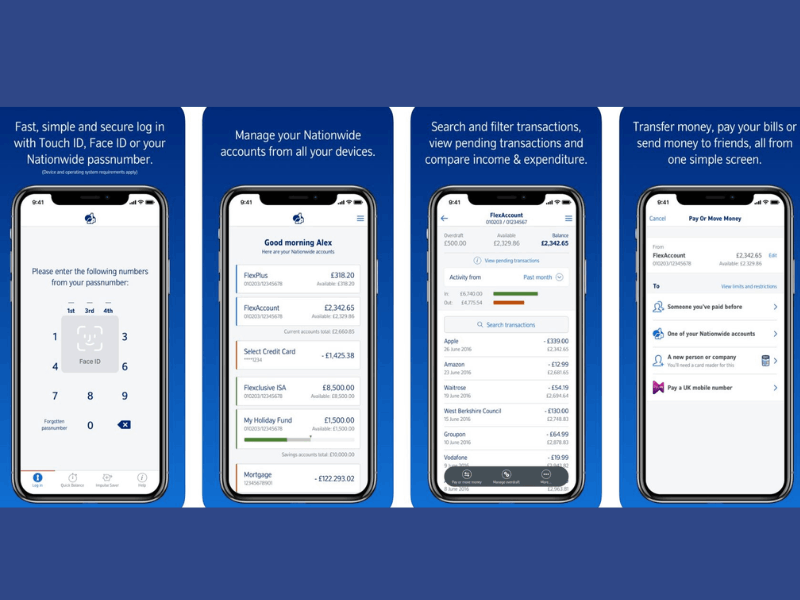

With the app, users can check their account balances, transfer money between accounts, and pay bills, all from the convenience of their smartphones.

This would make it easy for people to track their spending and ensure they always have enough money in their accounts to cover their expenses.

How Can You Download the Nationwide Mobile Banking App?

The Nationwide Mobile Banking app allows you to manage your money from your phone, tablet, and smartwatch.

You can download the Nationwide Mobile Banking app from the Apple App Store or the Google Play Store. To use the Nationwide Mobile Banking app, your device must run Android 5 (KitKat) or higher or Apple iOS 11 or higher. Operating systems that are in beta are not supported.

How Can You Setup the Nationwide Mobile Banking App?

Once you have successfully installed the Nationwide Mobile Banking app on your phone, you will need to set up the app and an account on the app.

To set up the Nationwide Mobile Banking app, you need to use your online banking information or your Nationwide account information to sign up. You then must enter your registered account on the app if you have an existing Nationwide online banking account.

You must provide your newly-opened Nationwide account information to create a profile on the bank's online and mobile banking services. After you finish entering your information, there will be a verification code.

The code will be sent directly to your registered phone number, so submit your active phone number. Once you have submitted the code, you can enjoy the mobile banking app's features. However, there are instances when it may take 24 hours for your current account to appear.

Can You Change Your Details Using the Nationwide Mobile Banking App?

After setting up your Nationwide Mobile Banking app, you can still change some of your account details for whatever reason. For security purposes, you can change your pass number.

You can update your personal information, such as phone number and address through the app. Once you've changed them, Nationwide will update their records accordingly.

What Are the Security Features of the Nationwide Mobile Banking App?

In addition to the convenience of mobile banking, the Nationwide Mobile Banking app also provides greater security for users. The app uses multiple layers of security, such as biometric authentication and encryption, to protect users' financial information.

This will give users peace of mind knowing that their money and personal information are safe and secure. Nationwide offers a way to ensure the safety of its customers. First, Nationwide is proud of its sophisticated encryption technology to protect data processed online using the mobile banking app.

You can secure your Nationwide Mobile Banking app account using the biometric authentication feature. If your mobile device supports face and fingerprint recognition, you can set it up for your Nationwide Mobile Banking app.

Moreover, the mobile banking app supports limited trusted devices only. Every customer can only register up to six devices, wherein the bank will only allow them to access their respective Nationwide Mobile Banking app.

What Are the Other Security Features of the Nationwide Mobile Banking App?

When you log on, Nationwide tells you to protect yourself from fraud and gives you a link to security tips to stay safe. It's also important to note that you can't take screenshots in the app, which makes it safer.

Nationwide ensures that you are the only one accessing your account by sending email or alert texts when a new device accesses your account. If you forget the app open for a period, the Nationwide Mobile Banking app will automatically log you out to keep your account safe.

How Can You Transfer Money Using the Nationwide App?

One of the main features of the Nationwide Mobile Banking app is the ability to make money transfers. You can quickly pay a person or a company using the app. You need to click the "Payments & Transfers" option on the right drawer on the Home tab.

Then, tap the "Pay or Move" money to select the Nationwide account you want to use for the transaction. Before you input the name of the person or company, the mobile banking app will provide a reminder regarding fraud and scams.

Then, you can enter the name and account number of the person you will send the money. You don't need to worry if the money will be transferred successfully by the right person because Nationwide will check if the account you are sending money to belongs to who you expect by matching the information you provide.

Thus, it may take a few moments before you can proceed. The app will inform you whether there is a close match or no match. Proceed to send if it's a close match, and recheck the account information if there's no match at all.

How Can You Move Money on Your Accounts via the Nationwide App?

Aside from transferring money to a person or company, you can move your money between Nationwide accounts through the Nationwide Mobile Banking app.

This is essential when you need an extra balance for your purchases or credit card payments. You don't have to visit a branch to transfer balance among your accounts manually; you can do it with your fingerprints.

How Can the Nationwide Mobile Banking App Help You Save Money?

There are some great budgeting tools in the Nationwide Mobile Banking app. The "Impulse Saver" feature is one of these. This feature is aimed at Millennials and lets them put money into their savings account instead of buying something on the spot.

For example, if you're in town and want a coffee, but after considering the cost, you change your mind. With the Impulse Saver feature, you can put the money you would have spent on the coffee into a savings account with just a few taps on your phone.

Since the feature came out in 2014, users have saved more than £20 million, with an average deposit of £30. The ability to quickly and easily compare income and expenses is at the heart of the Nationwide app.

When you log into your account in the app, you'll see a chart that shows your income and expenses over a certain period. This makes it easy to see how well your budgeting is going.

Can You Freeze Your Card Through the Nationwide Mobile Banking App?

Freezing your card is easy if you happen to lose or misplace your card. This feature stops all card transactions, but not recurring payments, Direct Debits, standing orders, or payments made with Apple Pay or Google Pay.

This will give you time to look for your card without worrying if other people might be using your card in the meantime. If you cannot find the card, it is best to report it lost or stolen to the bank using the Nationwide Mobile Banking app.

If you find the card, you can unfreeze it on the Nationwide Mobile Banking app. The app allows you to freeze and unfreeze your card anytime unlimitedly.

How Can You Apply for a Credit Card via the Nationwide App?

Going online is the quickest and easiest way to apply for Nationwide to open a new account. You may also do this through the Nationwide Mobile Banking app. However, you will still be directed to the application landing page of the organization's website.

You can open a sole or joint account, a second account, or switch your existing account over to Nationwide by going to the website for Nationwide.

Even if you submit your application to open an account with Nationwide online, you will still be required to bring in some form of identification and complete the process in person at a local branch.

Can You Verify Your Online Purchases Using the Nationwide App/

You may also view your current purchases or transactions. It is possible to cancel purchases if you want to via the Nationwide Mobile Banking app.

Nationwide ensures that all of your online purchases are valid. In this way, you can verify the transactions made on your account. You can immediately report via the Nationwide Mobile Banking app in case of unauthorized transactions.

Conclusion

Overall, the Nationwide Mobile Banking app provides a convenient and secure way for customers to manage their finances from anywhere at any time.

With the Nationwide Mobile app, users can easily access their accounts, transfer money, and pay bills, all from the convenience of their smartphones.